EU intra-community distance selling

Distance sales within the European Union include cross-border sales of goods and services to a private consumer (B2C) in another EU Member State when the seller doesn’t meet face-to-face with the customer. Organizations must ensure that the VAT on distance sales is paid to the Member State in which the goods or services are delivered.

Note

This remains true even if your organization is located outside of the European Union.

While this regulation mainly applies to eCommerce sales to private EU consumers, it is also valid for mail order sales and telesales.

The Union One-Stop Shop (OSS) is an online portal where businesses can register for the OSS and declare their intra-community distance sales. Each EU member state integrates an online OSS portal.

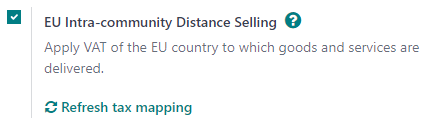

The EU intra-community Distance Selling feature helps your organization comply with this regulation by creating and configuring new fiscal positions and taxes based on your company’s country.

Configuration

Go to , then enable EU intra-community Distance Selling (or EU Digital Goods VAT if you created your database before July 1, 2021), and Save.

Important

Please upgrade the module l10n_eu_service if you already installed it before July 1, 2021, or if you activated the feature EU Digital Goods VAT in the Accounting settings. Then, make sure to refresh the tax mapping.

Fiscal Positions and Taxes

Once enabled, the feature automatically creates all the necessary taxes and fiscal positions needed for each EU member state, based on your company’s country.

We highly recommend checking that the proposed mapping is suitable for the products and services you sell before using it.

Refresh tax mapping

Whenever you add or modify taxes, you can update automatically your fiscal positions.

To do so, go to and click on the Refresh tax mapping button.